August 2021 Newsletter

Welcome to the August 2021 issue of the Global Washington newsletter.

IN THIS ISSUE

- Letter from our Executive Director

- Issue Brief: COVID Forces Rethinking of Education Strategies and Tactics

- Organization Profile: Alliance for Children Everywhere: ACE is Truly an Alliance for Children Everywhere

- Goalmaker: Atul Tandon, Opportunity International

- Welcome New Members

- GlobalWA Member Events

- Career Center

- GlobalWA Events

Letter from our Executive Director

As the start of school for my kids approaches, I am reminded of the importance of education with good teachers and the proper infrastructure to ensure my children are safe and well taken care of during their school day, including meals, adequate staff, and appropriate learning materials. COVID has forced not only my school district but just about every school district in America to provide alternatives to education delivery – and we could. We were provided laptops, access to online lessons and learning management systems – and we already had internet access in place to manage this continuity of learning. While it had its challenges, we were privileged to have an online option.

Millions of children across the globe have not been so lucky. For them, education abruptly stopped. Schools closed. Teachers moved back to their villages. Technology, such as smartphones and laptops, were not available. The infrastructure was not in place to be able to manage such a drastic change.

Many of GlobalWA member organizations have responded to this upheaval of their educational programs through adaptation and experimentation. It is wonderful to see how many of these children now have access to some form of continued education. The August Issue Brief examines how Ashesi University provided laptops and stipends for food to allow students to keep learning from home, how Alliance for Children Everywhere supports the whole family structure to allow the space for the children to keep learning, how Opportunity International provided financial support through their EduFinance program to ensure teachers and schools could maintain their programs, and more.

Our hope is that through these examples, other global education organizations can learn and adapt. Education is the backbone of successful, thriving societies and we all have to work together to weather this pandemic.

I’m also thrilled to announce that registration for our 2021 Goalmakers Conference on December 8 and 9 is now open! The first day of this event will be virtual and the second day will be in-person in Seattle. The in-person event will be a homecoming after a long stretch of only online communication. As always, we will monitor public health guidance and make contingencies, but we are hopeful that we can gather again in-person to spark those connections vital to your work. I hope you can join us!

Kristen Dailey

Executive Director

Issue Brief

COVID Forces Rethinking of Education Strategies and Tactics

By Joanne Lu

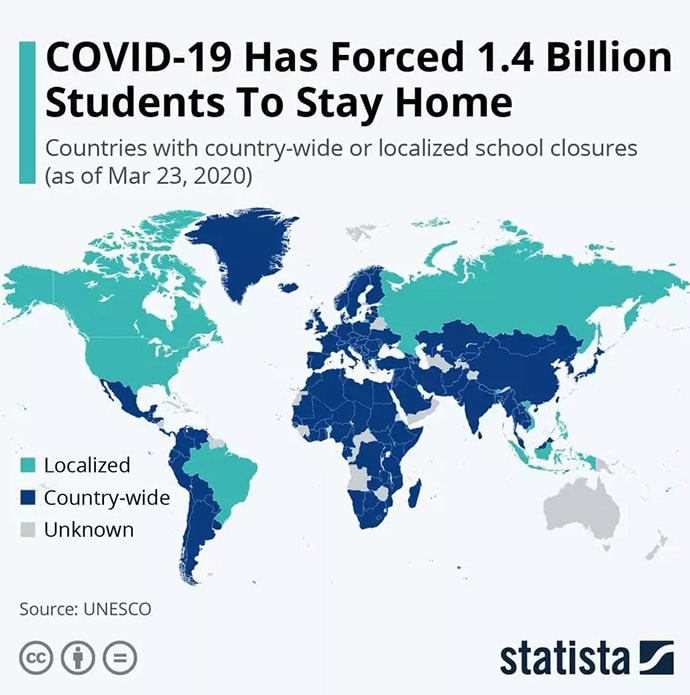

Even before the COVID-19 pandemic, the world was not on track to achieve Sustainable Development Goal 4: Quality Education. Being able to ensure inclusive and equitable quality education and promote lifelong learning opportunities for all by 2030 was going to require a global concerted push. And then, with the global COVID pandemic, came the school closures and the economic aftershocks that have effectively ended the educational prospects of millions of children around the world. That is, unless we can do something about it.

Image credit: Statista

The world could limit its educational recovery response to just returning enrollment and learning to pre-pandemic levels. But many experts see the pandemic as an “opportunity to reset education.” The world was not on track to achieve SDG4 by 2030 because of glaring inequalities in the global education system. COVID-19 highlighted and exacerbated those challenges. The question is, since we have to rebuild education anyway, shouldn’t we do it in a way that’s more inclusive, more equitable and of better quality? Experts say that if we don’t, not only will we still fail to achieve SDG4, but we will be setting ourselves up for another crisis down the road when another major disruption strikes. In a world with increasing climate disasters, it seems all but inevitable.

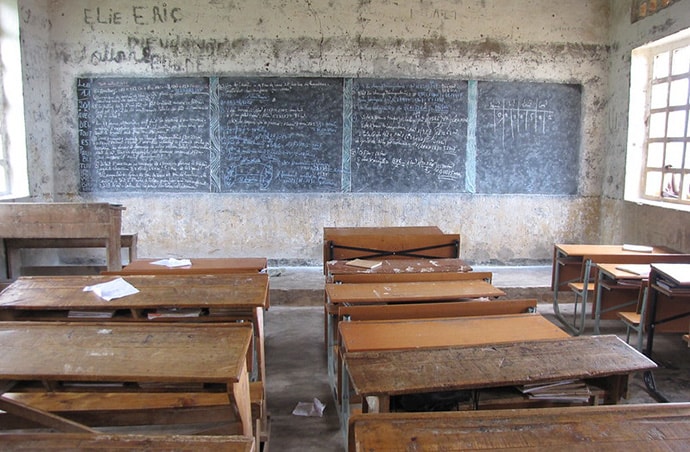

Empty classroom in Burundi

Most wealthy countries adapted to the COVID shutdowns by moving their classrooms online. While not an ideal learning environment for many students and their families, it at least allowed most students to continue learning. But this shift also highlighted the massive digital divide between wealthy and under-resourced contexts.

In Ghana, Ashesi University has done their best to keep their students on track with online classes. But to do so, they’ve had to provide laptops to students who indicated they couldn’t otherwise access classes. They also provided monthly data bundles to all their students. Additionally, students on full scholarships, which covered meals on campus, were given stipends to support them at home, and those with tuition arrears were allowed to defer payments and continue classes without disruption. Still, a few students had to defer their classes because they live in locations with weak internet infrastructure.

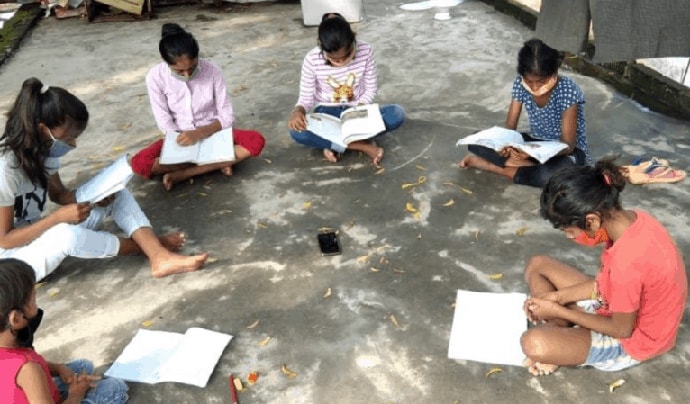

These types of barriers prompted a Mona Foundation partner in India to launch a phone-based program for students in poor, remote communities. Under this program, schools loan select students a smartphone through which those students can access online classes and also facilitate learning for other students in their neighborhood. Mona believes that in order to address the root obstacles that are preventing us from achieving SDG4, we have to raise the capacity of local organizations – like the one that launched the smartphone program – to solve their own issues. Grassroots organizations, Mona believes, are the ones who can make sure that gaps in education and beyond are addressed contextually and sustainably.

Photo Credit: Study Hall Educational Foundation/Mona Foundation

This is especially important as we think about achieving inclusive and quality education for all, because if COVID has taught us anything, it’s that education is critical for the future, but it doesn’t exist in a silo. If families don’t have money, they won’t send their children to school. If children are hungry, they can’t learn. If a major crisis, say a global pandemic or natural disaster strikes, classrooms will be closed. That’s why the Alliance for Children Everywhere (ACE) takes a whole family approach to child welfare, with food relief, economic empowerment programs as well as free community-based primary and secondary schools. For children who cannot remain with their families, ACE also facilitates fostering and adoption. But the pandemic’s disruption to their schools has prompted ACE to question the conventional schooling model entirely. Instead, ACE is exploring whether learning can be more evenly dispersed between households, communities and classrooms so that future crises will not cause as big of a disruption.

In Afghanistan, Sahar Education for Afghan Girls is in the process of building a boarding school for girls so that they will have at their fingertips all the resources they need, including internet access, to complete their education. However, the pandemic slowed those plans. Then, in light of recent insecurity following the U.S. withdrawal from Afghanistan, Sahar had to pause construction of the boarding school as well as its other programs that support girls’ education (Digital Literacy, Early Marriage Prevention and Men as Partners in Change). They’re hoping to resume construction and operations by the fall.

Photo credit: Sahar Education

Of course, all these initiatives take financing, which is where organizations like Opportunity International come into play. Opportunity’s Education Finance (EduFinance) program partners with financial institutions to support local private schools, teachers’ salaries and parents. This, in turn, leads to jobs and economic growth for entire villages. When the pandemic hit, EduFinance became a critical safety net for many of these schools, teachers and students. They extended grace periods for loan repayments, increased teachers’ salaries and helped digitize lessons to keep schools open.

Amid all the harm that the pandemic has wrought on education around the world, it has also forced us to reevaluate what inclusive, equitable quality education looks like. Perhaps some of the adaptations that this crisis has forced educators to make will, in the end, accelerate progress toward SDG 4. Regardless, it is clear that the pre-pandemic model was neither resilient nor effective enough. So, as the world braces for third and fourth waves of the virus, our work is cut out for us – not for a return to normal, but rather to build back better so that every child can have access to quality education by 2030.

The following Global Washington members are helping with education in middle and low income countries.

Alliance for Children Everywhere

Alliance for Children Everywhere’s mission is to bring orphaned and vulnerable children into secure families, schools, and communities. We prioritize child safety and permanency in a stable, loving family environment. That means: safety first, and family as soon as possible. Children without families face lifelong risks. We help provide physical and emotional protection for children in crisis, reintegrate children with their biological family members and find alternate homes through fostering or adoption for children without available family. Our vision is a permanent, secure, and loving family for every child. There are over one million orphaned children in Zambia. While institutions can provide them life-saving rescue, they cannot replace the love of a secure, permanent family. ACE protects families in crisis; restores orphaned children to family; and strengthens communities through economic empowerment and education.

A Child’s Notebook believes all children deserve a quality education and partners with rural communities to invest in the lives of children in Southeast Asia. With Lao People’s Demographic Republic having one of the highest poverty rates in Asia, A Child’s Notebook selected this country to improve education as first . As many as 34 percent of the primary schools lack both water supply and latrine facilities, and most schools are poorly constructed with unsafe and unhygienic condition. It is not uncommon for students to study in a building with a dirt floor, no windows, and no toilets or running water. Since 2018, A Child’s Notebook has partnered with five villages to remodel or build new schools and dormitory serving over 600 students. This approach has been successful because the communities have been active partners by providing volunteer labor, sourcing local materials, and leadership of the projects. Despite the many challenges the people of Lao PDR face, including the recent COVID-19 pandemic, these communities show an enormous commitment to education and believe it is the vehicle to improve the lives of their children, families, and community.

Ashesi is a private, non-profit liberal arts university located in Ghana. Its mission is to educate a new generation of ethical and entrepreneurial leaders in Africa; to cultivate within its students the critical thinking skills, the concern for others and the courage it will take to transform their continent. Ashesi Foundation in Seattle builds a global community for Ashesi University.

buildOn’s global mission is to break the cycle of poverty, illiteracy, and low expectations through service and education. buildOn partners with rural communities in developing countries, empowering locals to build schools, enroll out-of-school children, and educate adult learners. We work in eight countries, including Burkina Faso, Guatemala, Haiti, Malawi, Mali, Nepal, Nicaragua, and Senegal.

buildOn’s School Construction Program uses a participatory methodology to ensure each community is leading the project. buildOn contributes engineering, materials, and skilled labor. Each community provides land, local materials, and the volunteer labor it takes to build the school. Every village also promises to send girls and boys to school in equal numbers.

Once a school is completed, communities participate in two additional programs. Our Adult Literacy Classes teach women and men literacy and numeracy through the lens of health, enterprise, and relevant life skills. Our Enroll Program identifies school-age children who aren’t currently enrolled in school and works with their families to ensure they can start learning.

Since 1991, buildOn has constructed 1,993 schools worldwide, with more than 299,400 children and adults attending these schools every day.

ChildFund International serves in 24 countries to ensure that children and their families have access to educational and livelihood programs to further their education. To ensure the continuing sustainability of educational programs, ChildFund designs contextually and culturally appropriate programs with a gender equity lens that include greater participation of girls in school, aiding in the rehabilitation, construction, and equipping of community schools, assisting families with indirect costs, including books, uniforms, and educational kits containing school supplies, teacher trainings to improve the quality of teaching and learning, and working with parent-teacher associations to ensure that schools are safe and healthy learning environments for children.

Days for Girls International is an award-winning NGO that works to shatter stigma and limitations associated with menstruation for improved health, education and livelihood outcomes. To date, Days for Girls has reached more than 2.2 million women and girls in 144 countries on 6 continents with quality, sustainable menstrual care solutions and health education.

Knowledge is power, especially when it comes to menstruation. Access to timely, accurate health information is critical to shattering the stigma around menstruation and building a more equitable world. That’s why Days for Girls washable pads are always paired with comprehensive menstrual health education – for menstruators, families and entire communities. Check out our Ambassadors of Women’s Health Training and Men Who Know curriculum to learn more about the impacts of these of these life-changing programs. Visit daysforgirls.org today to get involved.

Girl Rising uses the power of storytelling to change the way the world values girls and their education. We ignite action for girls’ education and gender equity by changing attitudes and harmful gender norms through programming and campaigns reaching families, communities, corporations, governments and the general public.

Our work builds voice, agency and confidence in girls so that they can persist in their education; fosters a more inclusive learning environment that leads to improved education outcomes for girls; and changes attitudes and social norms.

In the wake of COVID-19 and its wave of shadow epidemics, our work has taken on new urgency. In addition to the 130 million girls who were missing from classrooms around the world before the pandemic, an estimated additional 11 million girls may never return to school. Girl Rising has been working closely with our local partners in 12 countries to adapt our programming and continue to reach girls in the wake of the crisis. We are supporting our partners with at-home learning resources, and in some cases emergency funds, as well as pivoting to new on-line platforms including radio programming and low-tech solutions such as WhatsApp.

Heifer International embraces education across its programs, providing a wide range of training covering animal management, financial literacy, nutrition, and much more. It works alongside communities to assess their needs and deliver appropriate support as they develop food and farming business that provide sustainable living incomes. In Orisha, India, poultry farmers have received training to use low-cost biosecurity measures to improve the health of their birds and increase resilience to the conditions created by the pandemic. Using detailed record keeping, business owners build plans for the future and grow their businesses. In Kenya, many small-scale dairy producers lack the technical knowledge they need to earn a living income. Lockdowns and movement restrictions have made in person training sessions impossible. Heifer Kenya is working to bring training to digital extension services to rural communities using technology.

The Hunger Project (THP) envisions a world where every woman, man and child leads a healthy, fulfilling life of self-reliance and dignity. Part of our multi-sectoral approach includes supporting access to education which is why a core pillar of our work is to “start with women.” The pandemic exacerbated educational challenges for adolescent girls in India, increasing high rates of child marriage, extreme poverty and familial responsibility.

With the pandemic closing schools, THP learned holistic action was most effective in reducing challenges to continued education in India. THP distributed Food and Creativity Kits that included nutritional food, basic stationary, sanitary pads and packets of information on governmental resources. These provided resources and information, fought boredom and included basic tools needed for learning and exam preparation. Thousands of girls are also engaging civically, leading online support groups, sharing governmental resources and ‘how to guides’ on negotiating the right to continued education. This work was designed to provide resources to reduce extreme poverty, which often leads to child marriage and more familial responsibilities, and increase educational motivation, even without a school setting.

THP observes that this holistic approach to COVID-19 is working as girls aren’t dropping off the radar and that school remains a viable option.

Mission Africa provides Nigerian children in remote villages with quality education primarily through two programs.

High School Diploma Program: Since 2008 the Mission Africa has awarded a six-year financial scholarship to 50 underprivileged high school students in the villages of Nigeria. The scholarship covers the full year cost of tuition, 2 school uniforms, school supplies and a backpack. The scholarship winners receive these benefits for 6 consecutive years until they graduate. Once they graduate a new 50-student scholarship cohort will be selected to receive scholarships.

Books for Africa: Since 2010, Mission Africa has donated approximately four million books to countries in Africa. In most African countries, schools must have approved libraries to be accredited for their national high school diploma exams. Mission Africa accepts donations of books from school districts, libraries, organizations and individuals for students in Africa who have no books. These books are picked up by Mission Africa volunteers, sorted by subjects, inventoried, packed and shipped in 40 feet container loads to Africa. The books are then donated to village schools and libraries.

We believe a successful life is an engaged life—and the key to staying engaged is staying curious. Our faculty inspires students to continually ask questions, to remain open-minded about outcomes, and to see connections in the world at large. In turn, students are prepared not just for college, but to live with meaning and joy—wherever life takes them. We are a diverse community of people who challenge each other to learn in a healthy, creative, and collaborative atmosphere of respect for ourselves, others and the environment.

We graduate students with historical, scientific, artistic, and global perspective, enabling them to think and act with integrity, believing they have a positive impact on the world.

In support of student and faculty well-being and continued learning during COVID-19, Northwest School faculty designed a Remote Learning Program for students 6-12. For details about the Program, please visit our Remote Learning Program page.

Opportunity International designs, delivers, and scales innovative financial solutions that help families living in extreme poverty build sustainable livelihoods and access quality education for their children. We equip families with the tools and training they need to build their businesses, improve their harvests, provide for their families, send their children to school, and break the cycle of poverty. Opportunity International’s Education Finance program (EduFinance) helps parents access the resources necessary to send their children to school and helps affordable private schools provide quality education to students.

At Rwanda Girls Initiative, they know that education is the key to gender equality. They believe that investing in girls education, especially secondary education, is one of the most powerful levers one can pull to spark systemic change. When girls receive an education, they are more likely to lead healthy, productive lives, earning higher wages and participate in decision making in their community. Girls education fosters economic development, peace, and reduces inequalities between boys and girls. Still today, there are more than 132 million girls left out of school worldwide and only 25 percent of countries have achieved gender parity in upper secondary education.

As an all-girls boarding school in Rwanda, they have removed the most significant barriers to education for their students. Rwanda Girls Initiative is one of the most socio-economically diverse schools in Africa, with 100% of their students receiving some amount of financial aid. Their teachers and staff support an environment of academic excellence, problem solving, leadership and service; ensuring that graduates will become tomorrow’s leaders. To date Rwanda Girls Initiative has graduated 705 students; future scientists, entrepreneurs, advocates and thought leaders, who will bring insights and solutions to the biggest global challenges we face.

For 20 years, Sahar’s mission has been to provide safe spaces for girls to receive a quality education. Sahar partners with the Ministry of Education and Afghan-based organizations to build public schools and implement educational programs for girls, empowering and inspiring children and their families to build peaceful, thriving communities. Each academic year, 25,000 girls attend the thirteen public schools built by Sahar. The organization also provides a range of programs including: early marriage prevention, teacher training, digital literacy, and building gender allies to improve the achievement gap between girls and boys. In order to address this disparity, Sahar developed and implemented the Early Marriage Prevention program in 2015. Since its founding, 1,473 students have graduated from the program. In this program, girls are introduced to the importance of continuing their education, leadership skills and professional development.

As U.S. troops withdraw from Afghanistan, Sahar’s Board of Directors and staff have reaffirmed an enduring commitment to providing education in northern Afghanistan.

Sukarya’s “Education on Wheels” project mainstreams out-of-school children into the formal school system. The brightly coloured mobile bus is a familiar feature in Gurgaon and Delhi’s slums. COVID-19 hit children hard. They lost their routine of attending classes. Sukarya’s team was quick to introduce them to digital learning so they could later transition to physical classes.

The primary concern was to reduce drop-outs. Students were enrolled in EOW after lot of discussion with parents and seeing them opt out would reverse gains made by the project. A strategy using virtual study space with handholding support, counselling and tele-conversations was initiated.

Online classes saw student leaders engaging with those unfamiliar with Android phones. Activities enhancing interactivity and self-worth like recitation, storytelling, play acting and craft were taken up. Online monitors sensitized classmates on COVID protocols, nutritious food, turning watchdogs and reporting cases needing attention so that Sukarya could provide relief. These zoomed enthusiasm and got students to join online classes.

Food shortage and acute hunger was a big concern. Sukarya distributed food and hygiene kits in these homes regularly. EOW has resumed visits and is ensuring minimum damage to children’s academic progress and overall wellbeing.

Sukarya USA in Seattle supports the cause of Sukarya for educating and empowering marginalized children and adolescent girls in India.

Save the Children and the Education Crisis of a Lifetime

Save the Children, the global leader in providing education to children in emergencies, is driving hard to combat the largest education crisis a generation of children worldwide is experiencing – the COVID-19 pandemic. Of the staggering 1.6 billion students who were out of school in 2020, millions have yet to return to classrooms as COVID-19 variants surge in countries. Child marriages and teen pregnancies are up, as more girls can’t go to school. Families who’ve fallen deeper into destitution are taking children out of school and forcing them to work. Our research points to over 112 billion days of lost learning in the past year. COVID-19’s immense disruption to learning will reverberate for generations to come.

Safe Back to School is our commitment to support distance learning and safely return 150 million marginalized girls and boys to school. We will make education systems more resilient and advocate to influence decisions on policy, legal, system or public investment to meet children’s right to an education.

Reversing COVID-19’s damage to learning is our top global education priority through 2024. We are uniquely suited for the challenge – we work in over 100 countries and have delivered quality education to over 273 million children in the last decade, which is more than any other global development organization. You can learn more about Safe Back to School here.

Schools for Salone expands access to quality education in Sierra Leone by building schools, training teachers, and empowering girls to stay in school.

Our organization was created in response to the destruction caused by civil war in Sierra Leone. Countless schools were reduced to rubble, leaving a generation of people without education and employment skills. Because Sierra Leone is one of the poorest nations in the world, it is even more difficult for communities to overcome barriers to education that continually arise – leaving children, their families, and their communities in a cycle of need.

We work with local partners to significantly increase the number of educated children in Sierra Leone by aiding and assisting communities to build schools and improve existing school infrastructure; by preparing teachers through a comprehensive teacher development strategy, and by conducting reproductive health education to keep girls in school and support their healthy growth and development.

Despite the challenges brought about by the COVID pandemic, we continue to make substantial progress in our goals of improving education opportunities for girls and women in Cambodia. With our superb on-the-ground partners, along with more than 20 grassroots local NGOs in and around Siem Reap, we are able to carry on with substantial support – all focused on continuing to educate the most vulnerable kids in Cambodia. This has taken on a variety of forms – all driven by the most pressing needs identified by the local communities and our partner NGOs. Specifically, over the past 18 months we have supported:

- Expanding internet connectivity

- Phone top-ups

- Teacher training for distance learning

- Creating new, on-line curricula

- Printing workbooks and homework assignments

- Mobile libraries

- Economic support to keep students engaged

- Sanitation and hygiene training for when in-person classes are possible

- Building community so local NGOs can support each other

- Food relief

- And many other locally driven projects

Nobody ever expected this pandemic to create such havoc in the educational sector. Nevertheless, thanks to our dedicated in-country staff and partner NGOs our work has continued to make an important difference in the lives of thousands of marginalized kids.

The Special Olympics Unified Champion Schools program is a school-based program for pre-K through university offered in more than 180 schools throughout Washington. Globally, the program is offered in 193 countries.

Unified Champion Schools is aimed at promoting social inclusion through intentionally planned and implemented activities affecting systems-wide change. With sports as the foundation, the three-component model offers a unique combination of effective activities that equip young people with tools and training to create sports, classroom and school climates of acceptance. These are school climates where students with disabilities feel welcome and are routinely included in and feel a part of all activities, opportunities and functions.

This is accomplished by implementing inclusive sports, inclusive youth leadership opportunities, and whole-school engagement. The program is designed to be woven into the fabric of the school, enhancing current efforts and providing rich opportunities that lead to meaningful change in creating a socially inclusive school that supports and engages all learners.

Recently, Special Olympics launched a new Unified program in support of refugees: Special Olympics Refugee Program Video

Organization Profile

Alliance for Children Everywhere: ACE is Truly an Alliance for Children Everywhere

By Joanne Lu

FaithWorks classroom. Photo credit: Alliance for Children Everywhere.

The story of Alliance for Children Everywhere (ACE) is one of evolution, learning, and adaptation. The organization as it exists today barely resembles the one that Virginia “Jennie” Woods founded in Arizona more than five decades ago. Yet, at the heart of it, ACE has always been – and always will be – a champion for the world’s most vulnerable children.

In 1969, Jennie Woods was moved to act when she saw a need for emergency rescue and childcare for orphaned and vulnerable children on Apache and Navajo reservations in Arizona. At the time, institutional care (e.g. orphanages, children’s homes, etc.) was the prevailing model for orphan care, so that’s what Jennie and her team provided. Out of that response, ACE was born.

Eventually, their faith-based ministry expanded to Guatemala and Peru. But by then, things had begun to shift within ACE. They started to lean more on local community leaders to implement and guide their programming.

Then, in the early 1990s, the HIV/AIDS epidemic hit Zambia hard, leaving the country with an unemployment rate of 70 percent and the highest per capita rate of orphans in the world. The country’s two existing structures for orphan support were quickly overwhelmed. In response, the Zambian government broadcast a global appeal for help from people and organizations with child welfare experience.

Family preservation. Photo credit: Alliance for Children Everywhere.

ACE once again sprang into action, lending support to local churches, leaders, the government, and community organizations. With its team of local social workers and staff, ACE launched two crisis nurseries for orphaned and abandoned children. And they also watched, listened and learned. They realized that many children who were coming to their crisis nurseries actually had living family. This is true for 80 percent of children in orphanages worldwide. For reasons like poverty, these families feel compelled to turn their children over to orphanages rather than try to keep them at home. Again and again, mothers told ACE partners and staff, “I would keep my baby at home if I could feed him.”

In response, ACE began to work toward that very goal. Realizing that family care, not institutional care, is the best environment for children, they launched programs to support the family unit, including food relief and economic empowerment programs for parents and caregivers. Those programs include skills training, savings groups, and seed capital for launching small businesses.

For children in need of immediate temporary care, including those who have been referred by the government due to issues like abuse or neglect, the crisis nurseries are still available. However, ACE’s goal is always to reunite the children with their families. If reintegration into their own families is not an option, then ACE facilitates fostering and adoption within Zambia – including outside of tribal lines. When ACE first began its work in Zambia, adoption outside of tribal lines was a relatively taboo subject. But with the help of local church leaders and social workers, ACE has been able to help normalize fostering and adoptions beyond one’s own tribe.

“We’re able to communicate that together, from our various tribes, our various backgrounds, we all belong within God’s family, and so do these children,” says Stephanie Johnson, ACE’s Director of Development and Communications.

It was also through conversations with local leaders that ACE realized they needed to take their prevention efforts one step further – to include education. Food relief and economic empowerment were well and good, but education would be the key to building up the next generation of parents and caregivers, and strengthening communities.

FaithWorks classroom. Photo credit: Alliance for Children Everywhere.

In 2001, ACE opened its first free community-based school. Today, ACE serves around 2,500 kids a year through its seven FaithWorks primary schools throughout Lusaka, as well as a secondary school. The primary schools are hosted in local church buildings and are open to all children in those neighborhoods whose parents cannot afford government schools. Some of the children are also single or double orphans, and for a number of the children, the school’s free lunch is their only daily meal. In light of these circumstances, the teachers are also trained to provide emotional and social support to guide their students through their life challenges and help them reach their goals.

For one student, Francis N’guni, that goal was to reinvest his education into the next generation of children in his community. Today, Francis is a head teacher at a FaithWorks school. Not only is he providing his neighbors’ children with a quality education, but he’s also mentoring them through the same challenges that he himself experienced as a child and student.

Of course, the pandemic has brought massive disruptions not only to ACE’s community schools, but also their other programs. That’s why they are holding discussions in real time about ways their work and schools can become more resilient to crises. For example, they’re exploring whether households and other community members can participate more in schooling so that in the event of another disaster, the disruption to children’s education will be minimal.

Moving forward, they’re also excited about expanding their influence beyond Zambia, but without a physical presence. ACE no longer works domestically, and its programs in Guatemala and Peru have long been handed off to local organizations. So, when it comes to programming, ACE is firmly rooted in Zambia. However, their decades-long evolution has taught them valuable lessons about child welfare, particularly how to move from institutional care to a holistic family support model. As it turns out, other organizations around the world are eager to learn from them. That’s why in 2020, ACE launched a consulting arm, called ACE Transition Partners, to guide institutions toward family-based care for tens of thousands of children in Africa and beyond.

It’s fitting, because after all, ACE is an alliance for children everywhere.

Goalmaker

Atul Tandon, Opportunity International

Atul Tandon Went From the Streets of Delhi to Wall Street. Now He’s a Banker for the Poor.

By Tyler LePard

Photo Credit: Opportunity International

There are moments in your life that cause you to reassess everything. They offer a chance to step away from your daily routine, stop thinking about your never-ending To Do list, and ponder the big question of what you really want to do with your life.

Atul Tandon was 39-years-old and running one of the world’s largest international banking efforts when he was faced with news of a serious health crisis. He had grown up on the streets of Delhi and ended up on Wall Street. But this moment caused him to pause and ask himself what would bring him the most joy. His answer? Help people have a better life. Atul decided he wanted to use the skills he learned through his career in financial services—how to see and unlock the potential in each one of us—to help people thrive, especially the ones who have been left out, like the people he grew up with.

A major career shift from international banking to humanitarian work wasn’t a hard decision for Atul. The hard part was to change his thinking around what counts as success. “It’s hard to go from an organizational culture and a career focused on the bottom line to a career and focus of life that was focused on people. It’s far more than the bottom line.” Atul shifted his thinking from the return on investment on dollars to matters of both the head and the heart.

Atul’s career change brought him full circle to where his life began.

A #2 pencil may seem like an insignificant object to many of us. For Atul as a child, it was so much more. He grew up in a family of limited means in India and his mother was determined to see him and his brother do well. This meant sacrificing to make sure they could attend school and get an education.

“I had this tremendous gift of my mother who loved me and who, at the same time, expected a lot of me,” Atul shared. “We didn’t have much, so my one gift a year was a box of #2 pencils and a sharpener. That was a constant reminder of my mom’s presence in my life, what she was giving in my life, and what those pencils could help me achieve. Even today when I see a #2 pencil, I get choked up.”

Atul finished school, got a Master of Business Administration, and built a successful career with Citibank, first in India and then in the United States. He learned how to manage enterprises and people and how to take ideas from their inception to tremendous impact. In India, Atul introduced services such as ATMs, credit cards, mortgages, consumer loans, and remote banking for the first time in the region. Those things may seem ordinary now, but in the 1980’s these were life-changing tools for millions of people.

Now, Atul is committed to addressing the question of “How do you lift up people at the bottom of the pyramid so they earn more income to invest back in themselves and their families, educate their children, and live thriving lives? … Most of humanity is at the bottom of the pyramid. Of the 7 billion people on the planet, about 3.5 billion are working adults and two billion are in the informal economy. They typically earn less than $3.50 a day and don’t have a defined means of income. That’s the human condition.”

Atul in Nicaragua. Photo Credit: Opportunity International.

These days, Atul calls himself a banker to the poor. “Now I have the great opportunity to go back to my friends who are bankers to the rich and say ‘Ok, what are we going to do together?’” He believes that both sides of financial services, serving the rich on one side and the poor on the other, are important. “We must treat everyone as if they have enormous potential. Talking about equality isn’t enough. The training I got at Citibank is what made me successful in the humanitarian sector.”

When asked what the thread throughout his career is, Atul said, “I’m a builder of people and of institutions. I’ve had the great fortune to build some of the world’s greatest financial institutions, nonprofits, and now to address extreme poverty. How do you build people and organize them into institutions to do more, with excellence on one side and a drive for real impact on the other. The most important thing is the people—both those who are impacted and the people who are doing the work so they thrive while doing it.”

Over 16 years, Atul joined World Vision, led United Way Worldwide, and then founded and served as the CEO of the Tandon Institute. In 2016, he joined Opportunity International as Chief Executive Officer and now he can’t imagine doing anything else. “I’m excited to be leading an organization singularly focused on helping families financially and helping children get an education.” Opportunity International is a global nonprofit organization that creates opportunities for entrepreneurs to build their businesses, children to go to school, farmers to feed their communities, and families to end the cycle of generational poverty. “If you can give people the financial resources, skills, and support they need, each person is perfectly capable of earning a living and getting out of poverty.”

“It’s important for mission-driven organizations like ours, whose purpose is to see poor households do better, to know enough about the financial sector, how to use banks and financial services, and package services for the poor so that they have positive outcomes,” said Atul. Opportunity International staff have learned to identify what the poor need, translate what the private sector has to offer, and help people find and use the services that will work best for them. If those services don’t exist, Opportunity International and their partners build them. “For 50 years we’ve been in the business of innovating financial solutions to serve the poor and deliver them at scale. We’ve built trust groups, banks for the poor, insurance programs, lending for the poor, education financing, and agriculture financing. We keep our focus on the poor, understanding what they need, and figuring out how to build them up so they have assets and income. We also learn how to use technology to bring down the costs of delivery and develop better services and solutions.”

Education is a pathway out of poverty, as Atul, #2 pencils in hand, found in his own life. “I’m here because I had access to good quality education. My parents and the Indian government gave me that opportunity.” Opportunity’s Education Finance (EduFinance) program partners with financial institutions to help independent local schools provide affordable, quality education. At the same time, it helps parents access the resources necessary to send their children to school. By connecting private sector finance to education providers in low- and middle-income countries, they are tackling the global education crisis and helping more children attend better schools. With help from the U.S. government and others, Atul aims to double the number of children in schools around the world.

Opportunity International also works with educators to increase education quality. They have developed training programs with schools and teachers in 25 different disciplines. Atul’s team helps them learn things like how to set up restrooms for girls that are secure and how to recruit and train teachers.

As Atul said, “This work fits well with the public sector. In most of the developing world, the government itself doesn’t have the financial capacity to provide a quality education to the population.” In Uganda, one of the places Opportunity International works, almost half of the population is under the age of 15, representing one of the youngest populations in the world. Only 53 percent of children in Uganda complete primary education. Forty-one percent of the people there live in poverty (on less than $1.90 a day).

Atul at United Nations. Photo Credit: Opportunity International.

Atul and his team believe that we can end extreme poverty in our lifetime. Helping households earn a better living and children earning an education are the key to achieving this. “When you bring those two things together you create lasting granular change at the bottom of the pyramid and the tide rises up for everybody. We have the means today—the financial, the economical, and the social networks, to accomplish both of those things.”

“I look forward to the day when all of us can go to bed on a full stomach,” Atul said. “We are called to love the least amongst us. I have the opportunity to work with a lot of good samaritans. They do the work. We provide the kindling. All of us can celebrate together.”

Welcome New Members

Please welcome our newest Global Washington members. Take a moment to familiarize yourself with their work and consider opportunities for support and collaboration!

National Museum and Center for Service

National Museum and Center for Service is a center for people to gather and be inspired to provide a hand up for their communities. Nmcfs.org

Member Events

August 19: Life Science Washington Annual Summer Social

August 19: Save the Children: Special Briefing on Crises in Haiti and Afghanistan 8/19 1pm EST

August 26: OutTalks: Responding to a Crisis: Insights & Impact from the Covid-19 Global LGBTIQ Emergency Fund

August 26: GSBA-Power Connect: Women in Business

September 14: 2021 YWCA Inspire Luncheon with Keynote Speaker Stacey Abrams

September 16: Hope for Life’s: 2021 A Week of Hope (Live Auction Portion)

October 2: TRIFC/Nepal’s 2021 Virtual Gala

Career Center

Donor Relations Coordinator // NPH USA

Senior Manager, SC Integrators Program // VillageReach

Check out the GlobalWA Job Board for the latest openings.

GlobalWA Events

August 26: Reimagining Education in Light of COVID-19

SAVE THE DATE: December 8 & 9: GOALMAKERS CONFERENCE